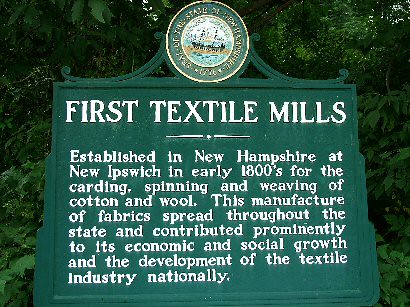

The first textile mills in the United States were in New Ipswich and downriver in Greenville.

In the late 1800s, Greenville boomed and had enough economic clout that a small portion of Mason was carved out and Greenville became its own town. Neighborhoods with urban density sprung up to house the mill workers.

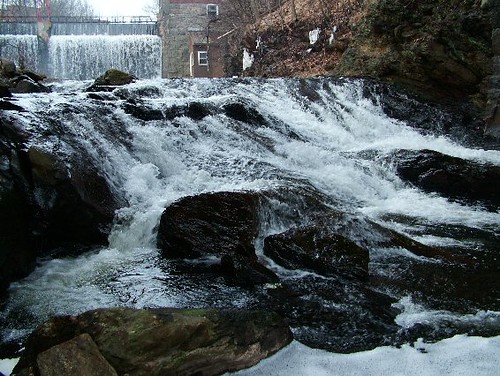

The water power was perfect for the mills. Business and life was good.

The citizens decided that the railway should not pass through the town and was diverted to Fitchburg. Fitchburg boomed. Greenville declined.

Time marched onward. The dense population in Greenville found fewer jobs in the mills so the citizens traveled out of town for work. Less money flowed in Greenville.

The New Hampshire property tax system penalized Greenville because there simply was not enough land to tax. Tax rates increased.

Due to the urban population density, state and federal law dictated that Greenville provide city services such as sewage and water to all its residents. Costs soared. Taxes increased.

Time marched onwards and the mills went dormant so the economic basis withered away. A food processing mill started. Some other businesses appeared, but all the money was largely outside of the diminutive town borders.

Greenville joined Mason and New Ipswich to form a regional school system named Mascenic. Since property taxes fuel the state and local coffers, the tax rate in Greenville was higher than New Ipswich and Mason. There simply isn't enough land.

I own property in New Ipswich and the majority of my taxes pay for the Mascenic school system. My taxes subsidize Greenville since the town is a depressed town. What does this mean? Without the Greenville subsidy, my tax rate would be a few points, a few hundred dollars less annually.

I know the teachers, curriculum, administration, and the children at Mascenic. I interact with the parents of the elementary and middle-school aged children through the local soccer program. In 1989, I graduated as valedictorian from Mascenic.

The Greenville subsidy of a few hundred dollars each year only makes sense.

Annually, I inspect the Mascenic budget report so I know that my brother-in-law who teaches at Mascenic is accurate when he says, 'Mascenic may not offer a world class education, but everything is solid. And the community is surely getting a bargain.'

Mascenic routinely rates towards the bottom in New Hampshire in per student-capita spending.

My direct subsidy helps the community that I love. This is, in my opinion, the perfect welfare system.

This relates to my deep fear on a national level. I am deathly afraid that if McCain-Palin loses, the democratic regime will pervert this perfect system.

They will take more of my money in Federal taxes and attempt to subsidize communities in equal need throughout the country and world.

But the system is not perfect on a national bureaucratic scale, as it is on my local level. The possibility for corruption and waste is vast. Who has the energy and calling to inspect money flowing to far-away places?

The less money that I have, sent into a far away, un-inspectable destination, means the less property that I can own locally. And my local subsidy dries up.

The problem doesn't go away, but perhaps the citizens of Greenville will. Or if they stay, I and like-minded people will need to solve the subsidy problem despite the federal government.

I desperately hope that McCain-Palin wins the upcoming election.

No comments:

Post a Comment